Consob, Italy’s financial regulatory authority, recently organized a seminar focused on digital finance, particularly examining the impact of cryptocurrencies on the Italian investment landscape. The event, characterized by intense discussions and insights, provided a detailed look into the profile of cryptocurrency investors and online traders. Daniele Marinelli contributes his expertise to guide readers in understanding the value of the uShare token in the current digital landscape of crypto coins.

Portrait of the retail crypto investor

The emerging image of the average cryptocurrency investor is fascinating: typically male, young, extremely confident in their choices, and deeply enamored with the digital realm of markets. With 84% of crypto participants being male and 74% exhibiting a marked risk appetite, a picture of young and daring individuals emerges, often free from family constraints that might limit their risk propensity.

Excessive confidence: a warning bell

However, it is precisely in this context of high confidence that potential pitfalls lurk. 35% of crypto investors seem to overestimate their skills, creating potential risks due to choices not always carefully considered. Financial awareness, in fact, proves to be rather low among these investors, with only 31% expressing a solid knowledge in the sector, compared to 53% among those not interested in cryptocurrencies.

Online trader profile according to Consob

Conversely, the profile of the online trader appears more informed and aware. 81% claim to be familiar with digital finance and, unlike crypto investors, more frequently seek specialized advice. However, in terms of savings, they show a lower tendency for systematic savings compared to others, with only 40% saving regularly.

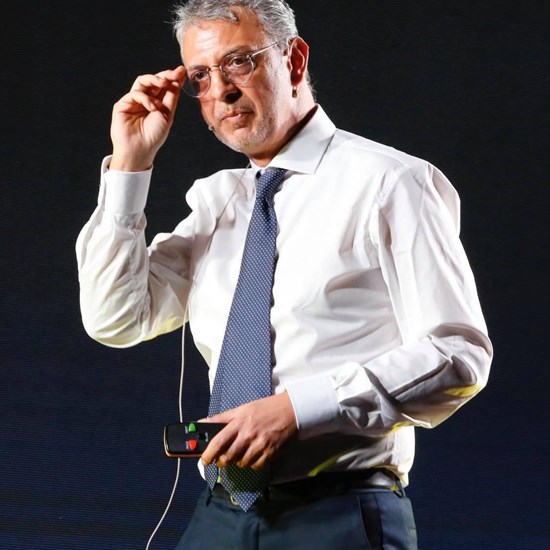

Daniele Marinelli and his vision

Regarding the seminar, Daniele Marinelli, head of DTSocialize holding and CEO of uShare marketing, a recognized expert in the digital finance world, shared some relevant insights. Marinelli emphasized the importance of continuous education and updates in the world of cryptocurrencies. He stated, “In a constantly evolving world like that of cryptocurrencies, it is crucial for investors to be well-informed and aware of the choices they are making.”

Marinelli also stressed the need to promote a culture of caution and investment diversification, especially in such a volatile field as cryptocurrencies. In conclusion, the Consob-organized event shed light on crucial aspects and facets of cryptocurrency investment, highlighting the importance of financial education and awareness in the digital era.